The demand for personal loans remains high despite negative press about the industry.

That’s why personal loan affiliate programs are great way to make money.

There’s something like 11% growth in this market, year-on-year.

Affiliate offers in this niche also tend to pay pretty well. That’s why our affiliate marketing statistics show that finance is one of the most profitable niches.

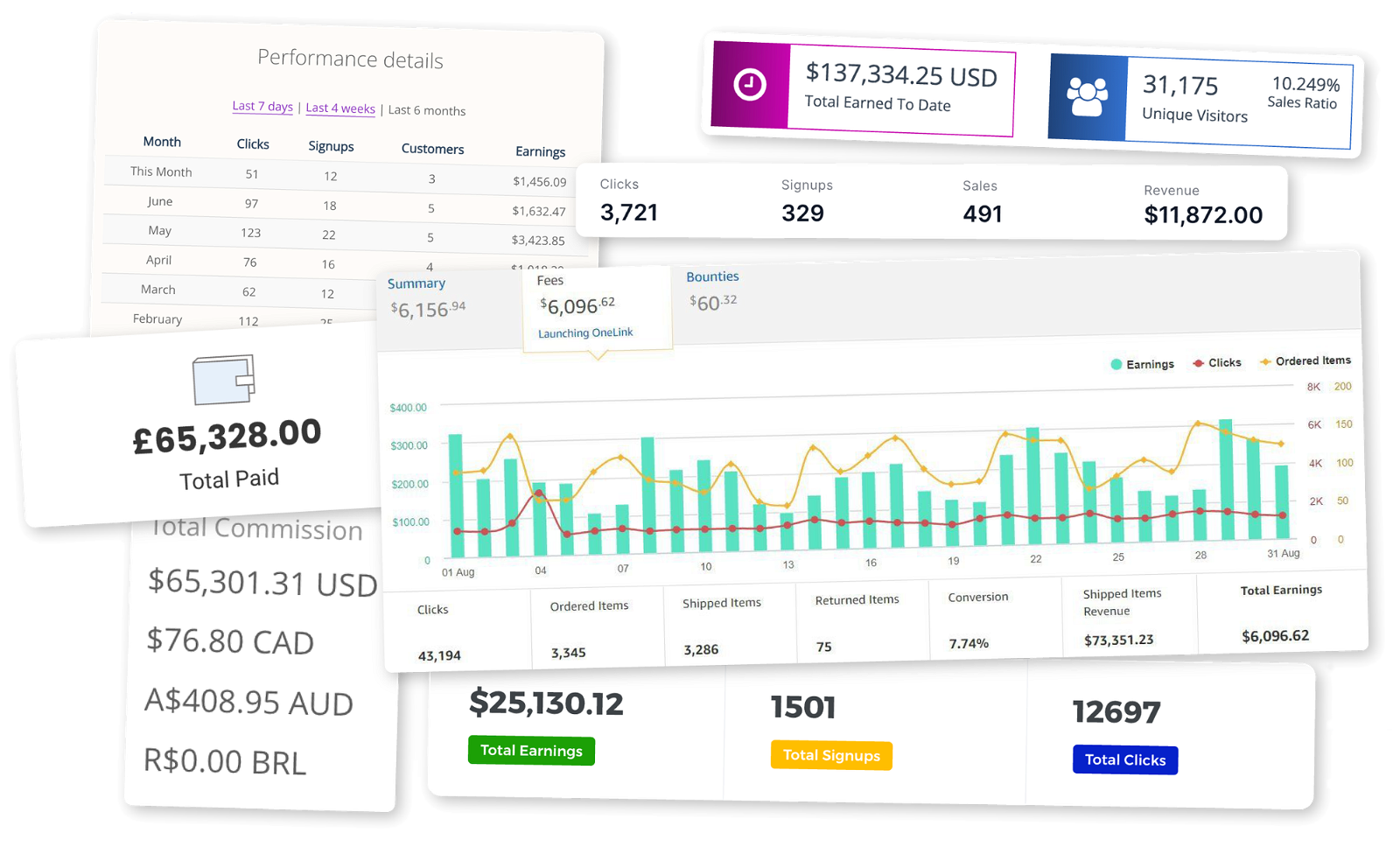

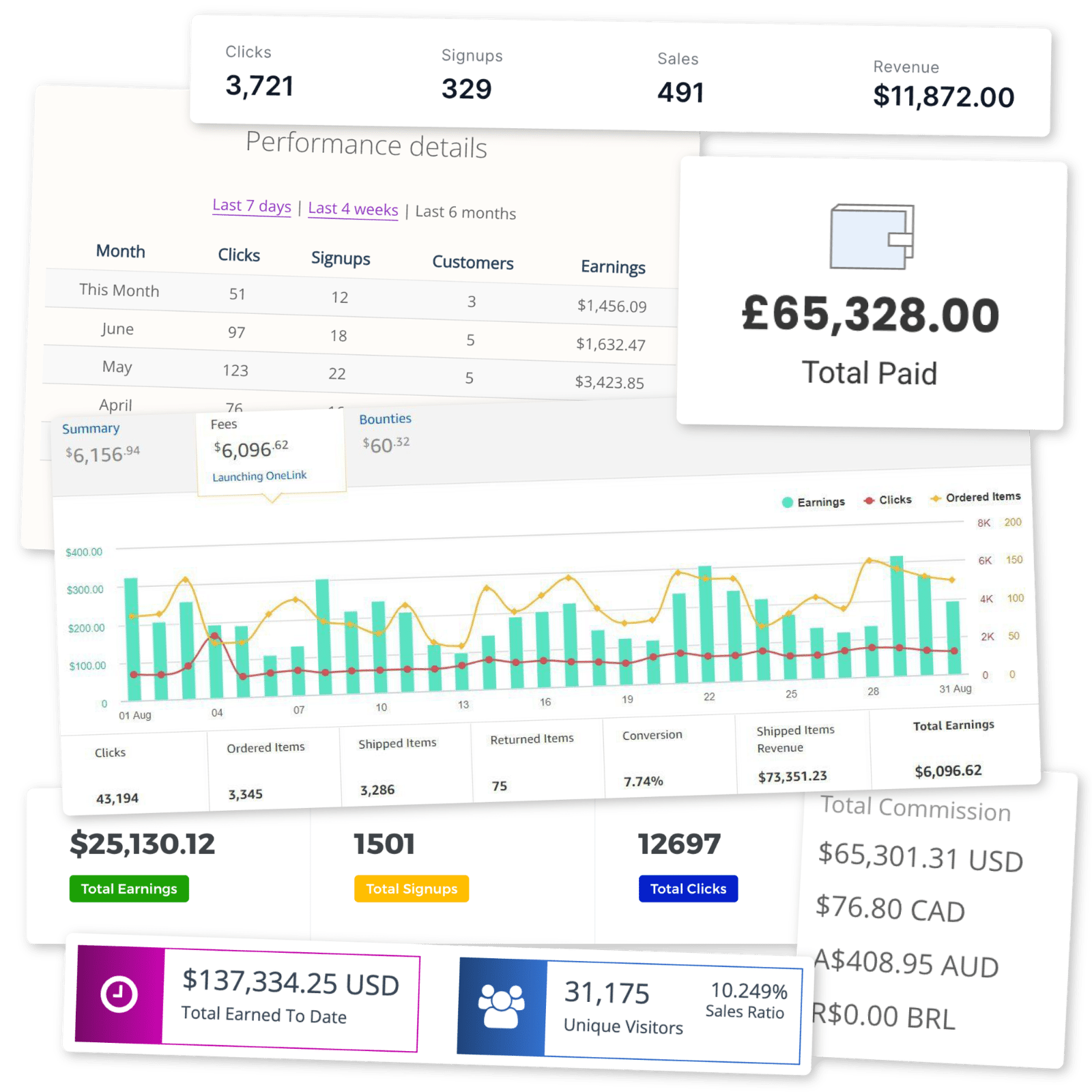

And we can say from experience that it’s a lot more fun earning big commission payments than smaller ones:

For those willing to participate in this industry, the financial rewards can be substantial as long as they have the right personal loan affiliate programs to promote on their site.

So, let’s take a look at what’s available.

Personal Loan Affiliate Programs

- LoanMart Affiliate Program

- Fairstone Affiliate Program

- Zoca Loans Affiliate Program

- Zippy Loan Affiliate Program

- Smarter Loan Affiliate Program

- SoFi Affiliate Program

- Viva Loans (UK) Affiliate Program

- Check Into Cash Affiliate Program

- Ace Cash Express Affiliate Program

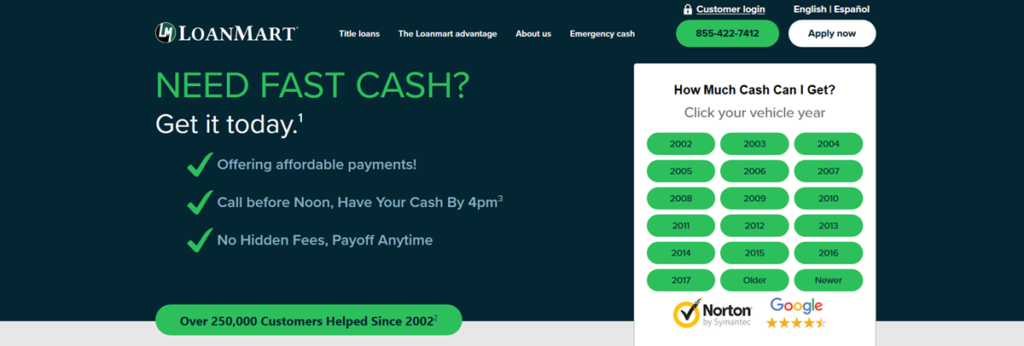

1 LoanMart

LoanMart offers short-term loans where you use your car as collateral.

LoanMart has been serving the title loan needs of its customer base for almost 20 years. More than 250,000 customers across 25 states and 427 cities have benefited from their services.

The application process is the same as that of other short-term lenders. You apply online and receive the money in your bank account. LoanMart does its best to process your loan application within 24 hours of approval.

How does this offer compare to the other loan affiliate programs listed here? You’ll earn a flat $100 commission for all funded loans. But that’s a once-off commission – there’s no room for recurring payments here.

- URL: LoanMart affiliate program

- Commission: $100 per lead

- Cookie duration: 30 days

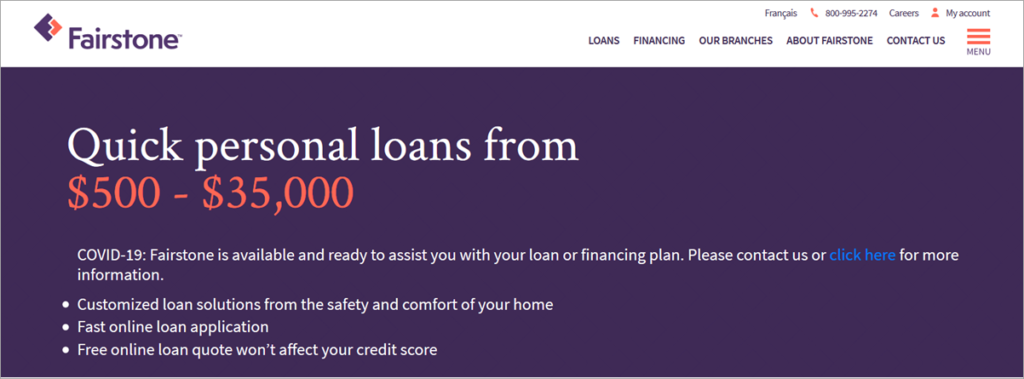

2 Fairstone

Fairstone provides its Canadian customers access to personal loans when banks aren’t an option. This is a fact of life for the many people still recovering from the 2008 financial crisis. But Fairstone isn’t a lender created by that crisis—it’s been in business for over 100 years.

You can apply online for personal loans up to $35,000 but as little as $500. They also accept online applications so the process won’t affect your credit score.

Plus, unlike most banks, you don’t need a perfect credit score to be approved for financial help.

Financial affiliate programs tend to be very lucrative, and this one is no exception. Affiliates earn up to $200 per approved lead for referring new customers.

- URL: Fairstone affiliate program

- Commission: up to $200 per lead

- EPC: CA$586.33

- Cookie duration: 30 days

3 Zoca Loans

Life is unpredictable and has the worst sense of timing. For example, when your refrigerator goes to kitchen heaven, you won’t have the money to replace it until your next paycheck.

That’s why short-term personal loans from companies like Zoca are so popular, even if they do have higher interest rates.

You can apply directly via their website for anywhere from $200 to $1,500. You get an instant decision, so there are no waiting days or weeks for your bank or credit union. You also don’t need good credit to apply for short-term financing.

So, what can you earn promoting this offer compared to other loan affiliate programs? You’ll earn $5 per lead, regardless of how much your referral borrows. That’s not a lot, but it’s better than nothing.

- URL: Zoca Loans affiliate program

- Commission: $5 per lead

- Cookie duration: 30 days

4 Zippy Loan

Zippy is a little different from most payday loan providers online. Instead of financing your request in-house, they connect you with their network of lenders, who can facilitate applications from $100 to $15,000.

The application process takes no more than 5 minutes, and you can access your money within a business day. Another perk is that some of their lenders offer repayment terms of up to 60 months and small business loans.

You need only be at least 18 years old and have a regular source of income—bad credit isn’t an issue. Successfully repaying your Zippy Loan can actually improve your credit score.

Becoming an affiliate of Zippy Loan could be very profitable as they pay $45 per lead.

But you only have a 1-day cookie to work with, so make absolutely sure your traffic is pre-sold.

- URL: Zippy Loans affiliate program

- Commission: $45 per lead

- Cookie duration: 1 day

5 Smarter Loan

Smarter Loan is Canada’s largest personal loans comparison site, spanning 50 providers offering loans ranging from $250 to $30,000.

Your visitors can save untold hours of Googling and browsing through short-term finance products on multiple sites. Instead, they simply need to decide how much they need to borrow and how long they want their repayment term to be and then match that against the different business and personal lenders listed.

You can simply use their’ Pre Apply’ service to tell them what loan you’re looking for, and they’ll find what you need.

Remember when we said that affiliate loan programs can be lucrative? For example, you can get a $140 affiliate commission for a single sale. That’s 140 very good reasons to promote this loan affiliate program.

- URL: Smarter Loan partner program

- Commission: $140 per lead

- Cookie duration: 30 days

6 SoFi

SoFi is about more than just being a lender. In their own words, they are “…a new kind of finance company taking a radical approach to lending… we’re all about helping our members get ahead and find success.”

Long story short, they’re the next generation of lenders for business and personal finance products.

You can borrow up to US$100,000 with interest rates as low as 5.99% but not more than 17.53%. And they even provide small business loans, just in case you were wondering.

With SoFi, you’ll earn $100 for a funded application or $150 for a funded student refinancing loan. And the even better news is that they’ve paid over US$10 million in affiliate commissions so far.

- URL: SoFi affiliate program

- Commission: Up to $150 per sale

- EPC: $101.21

- Cookie duration: 30 days

7 Viva Loans (UK)

And now we have an offer– Viva Loans. This short-term lender can help your visitors with unexpected expenses or bills up to $10K. Because medical emergencies, car crashes, or a burst pipe in your attic never give you a warning.

Repayment terms are no longer than 12 months but no less than two months. But do bear in mind that these loans are very much a “payday” product, so they have interest rates to match – with typical interest rates at around 600%.

This company is happy to pay you $45 for every new customer you send their way. You’ll only get paid if your referral qualifies, and then you receive their money.

- URL: Viva Loans affiliate program

- Commission: $45 per sale

- Cookie duration: 1 day

8 Check Into Cash

Check Into Cash has been providing what they refer to as “emergency credit solutions” since 1993. In other words, payday loans and other personal credit options, such as payday advances and check cashing services, are available.

And they do that from their 800 stores dotted across North America. Your visitors can apply for loans from $50 to US$1,000.

Applications can be processed in-store or online via their website, but the online option offers instant approval and the money in your bank account the next day.

You’ll earn $30 for a new customer’s application, but you’ll also get paid $10 if an existing customer applies for financial help. Something worth mentioning is that this program pays you when a loan is approved but before it’s funded.

So you get paid sooner.

- URL: Check Into Cash affiliate program

- Commission: Up to $30 per sale

- EPC: $94.66

- Cookie duration: 45 days

9 Ace Cash Express

I can’t claim I was familiar with Ace Cash Express before researching this niche. However, I was surprised to learn that they were founded in 1968 and are still in business today.

And that’s the business of supplying their local customers with short-term and cash advance loans. Their application process is the same as that of other similar lenders: you can apply online, get an instant decision, and receive your cash the next working day.

The amount your visitors can borrow and the repayment terms vary depending on their state.

This loan affiliate program has commission rates ranging from $5 to $60. But how do you know which products to promote? The $60 commission rate applies to funded installment and payday loans.

An Ace Cash Express loan, on the other hand, pays between $10 and $25 per referral.

- URL: Ace Cash Express affiliate program

- Commission: Up to $60 per sale

- Cookie duration: 45 days

Over to You

Not every affiliate feels comfortable operating in the “payday” loan scene.

I get that. But there’s a consistent demand for loans of this type.

So, you or another affiliate marketer will earn a commission for connecting people with third-party regulated providers.

And if you choose to dive in, you now have nine thoroughly researched loan affiliate programs to promote.

Are you not sure how to promote them or even how an affiliate program works?

Neither did we when we first started.

So, why not learn from our mistakes (and big wins) by watching our free training on building a profitable affiliate site?

There is no fake guru nonsense involved, I promise.